- Automotive Hard Silver Plating

- Energy Storage Connector

- Cable Harness Connector

- EV Charging Connector

- Electric Bike Charging Cable

- PCB Connectors

- EV Charging Equipment

- High Voltage Wiring Harness

- Charging Socket

- Adapter EV Charging

- AUPINS POWER Charge Pro

- EV Cable Harness Ultrasonic Welding

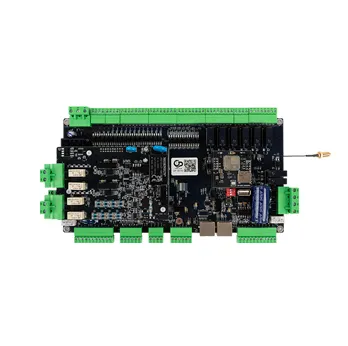

- EV Charge Control Board

- EV Charge Transformer

- ON BOARD CHARGER

-

Brass Connector Pin For IEC EV Charging Plug

Brass Connector Pin For IEC EV Charging Plug

-

Contact Pins For Sae EV Charging Plug

Contact Pins For Sae EV Charging Plug

-

Charging Pin Connector For GB/T EV Charging Plug

Charging Pin Connector For GB/T EV Charging Plug

-

NACS Connector Pin For Tesla EV Charging Plug

NACS Connector Pin For Tesla EV Charging Plug

-

Lamella Contact Pins

Lamella Contact Pins

-

Hyperboloid Contacts

Hyperboloid Contacts

-

Crown Spring Pins

Crown Spring Pins

-

Energy Storage Socket Connector

Energy Storage Socket Connector

-

Energy Storage Plug Connector

Energy Storage Plug Connector

-

SS1 Series Connector for Energy Storage Connector

SS1 Series Connector for Energy Storage Connector

-

SS2 Series Connector for Energy Storage Connector

SS2 Series Connector for Energy Storage Connector

-

Custom Cable Harness Assembling

Custom Cable Harness Assembling

-

Wiring Harness Connector

Wiring Harness Connector

-

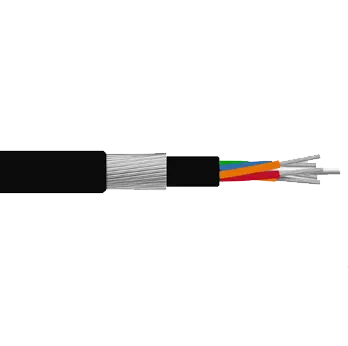

EN50620 Cables

EN50620 Cables

-

Electric Vehicle Charging Cable

Electric Vehicle Charging Cable

-

Elevator & Conveyor Cable

Elevator & Conveyor Cable

-

Industrial Cables And Wires

Industrial Cables And Wires

-

AC Charging Connector

AC Charging Connector

-

DC Charging Connector

DC Charging Connector

-

Type 2 Open End Charging Cable

Type 2 Open End Charging Cable

-

Type 2 -Type 2 Charging cable

Type 2 -Type 2 Charging cable

-

CHAdeMo Connector

CHAdeMo Connector

-

GB/T DC Charging Connector

GB/T DC Charging Connector

-

NACS Vehicle Plug

NACS Vehicle Plug

-

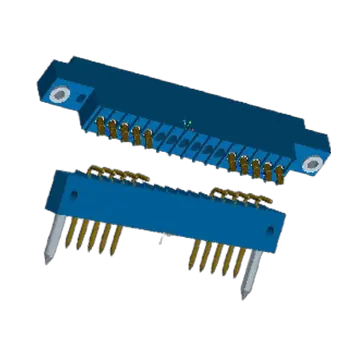

16 Core PCB Connectors

16 Core PCB Connectors

-

AUPINS Pogopin Hypertac Hyperboloid Contact

AUPINS Pogopin Hypertac Hyperboloid Contact

-

AUPINS Server Hashrate AI PCB Power Supply High Current Charging Terminal Pin

AUPINS Server Hashrate AI PCB Power Supply High Current Charging Terminal Pin

-

Mode 2 GBT Portable EV Charger

Mode 2 GBT Portable EV Charger

-

J1772 SAE Type 1 Portable EV Charger

J1772 SAE Type 1 Portable EV Charger

-

IEC62196 Type 2 Portable EV Charger

IEC62196 Type 2 Portable EV Charger

-

DC EV Charger

DC EV Charger

-

AC Socket Cable(AC Socket→Battery)

AC Socket Cable(AC Socket→Battery)

-

PDU Cable(Battery→Motor)

PDU Cable(Battery→Motor)

-

Motor Wire

Motor Wire

-

PTC Cable(Battery→Air Conditioner)

PTC Cable(Battery→Air Conditioner)

-

DC Socket Cable(DC Socket→Battery)

DC Socket Cable(DC Socket→Battery)

-

Ground Wire

Ground Wire

-

Three Phase Power Line

Three Phase Power Line

-

Air Pump Line→Compressor

Air Pump Line→Compressor

-

CHAdeMO DC Charging Socket

CHAdeMO DC Charging Socket

-

GB/T AC Charging Socket

GB/T AC Charging Socket

-

GB/T AC Electronic Lock

GB/T AC Electronic Lock

-

GB/T DC Charging Socket

GB/T DC Charging Socket

-

SAE AC Charging Socket

SAE AC Charging Socket

-

CCS1 DC Charging Socket

CCS1 DC Charging Socket

-

IEC AC Charging Socket

IEC AC Charging Socket

-

CCS2 Charging Socket

CCS2 Charging Socket

-

IEC Electronic Sockets

IEC Electronic Sockets

-

NACS Vehicle Charging Socket

NACS Vehicle Charging Socket

-

AUPINS A5 Series Portable EV Charger

AUPINS A5 Series Portable EV Charger

-

AUPINS C5 Series AC Wall-mounted Charger

AUPINS C5 Series AC Wall-mounted Charger

-

AUPINS EF040 Series Public DC Fast EV Charger

AUPINS EF040 Series Public DC Fast EV Charger

-

AUPINS EF160 Series DC Fast Charger

AUPINS EF160 Series DC Fast Charger

-

AUPINS EF400 series 360 kw/400kw Public DC Quick Charger

AUPINS EF400 series 360 kw/400kw Public DC Quick Charger

-

AUPINS S Series Type 2 IEC 62196 Charging Cable

AUPINS S Series Type 2 IEC 62196 Charging Cable

-

AUPINS T3 Series Portable Charger Mode2 Pro

AUPINS T3 Series Portable Charger Mode2 Pro

WHAT ARE YOU LOOKING FOR?